The media consumption landscape in Germany is evolving, and understanding these shifts is crucial for podcast publishers aiming to tap into this large market. The ARD/ZDF Online Study of 2023 (released in 2024) offers valuable insights into how Germans consume audio content, from traditional radio to podcasts and streaming platforms. For podcast publishers, these findings provide a clear view of the market. They could help build a roadmap to optimize content and distribution strategies to tap into the wider audiences in Germany’s digital audio space.

What is the ARD/ZDF online study?

The ARD/ZDF Online Study is an annual survey by Germany’s largest public broadcasters, ARD and ZDF. For over 25 years, it has tracked online media consumption and is therefore highly trusted. The study focuses on audio, video, and digital content trends and is a benchmark for understanding shifts in media habits in Germany. For podcast publishers, this study is an essential reference for navigating the evolving digital media landscape.

Finding #1: Audio dominates media consumption in Germany

The study shows that 81% of Germans aged 14 and above listen to audio content daily. This includes traditional radio, streaming services, and podcasts. On average, they spend about 175 minutes each day consuming audio, reflecting a return to pre-pandemic habits as commuting and daily routines resume.

Traditional radio still holds the largest share, reaching 68% of the population daily. However, digital audio formats, such as music streaming and podcasts, are steadily growing. For podcast publishers, that’s the opportunity.

Finding #2: Podcasts are growing, especially among the younger audience.

Podcasts are steadily gaining traction, with 20% of Germans tuning in at least once weekly. While this is still modest compared to radio, it marks consistent growth, especially among younger demographics driving the digital audio surge. The study shows that younger listeners (aged 14-29) are the most frequent podcast consumers, with 13% listening daily. Younger listeners (particularly those aged 14-29) are simply the primary drivers of podcast growth in Germany.

This highlights the need for podcast publishers to create content that appeals to younger audiences. Publishers can tap into this growing trend by focusing on relevant topics and formats.

As digital transformation continues, younger audiences are moving away from traditional radio. In workshops with broadcasters, we often challenge participants to “ask young people (aged 14-29) what FM or 101.3 FM means.” The younger the crowd, the less likely they are to tune in via a radio receiver—they click and swipe instead.

Germany is no different from other countries in this respect.

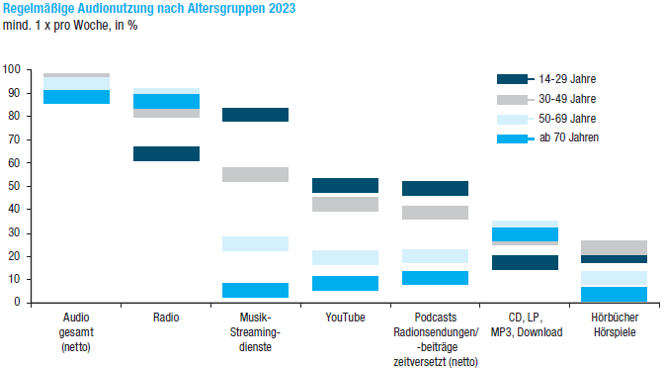

Regular Audio Consumption per Age Group in Germany

Finding #3: Podcasts and music streaming – a powerful combination

Streaming platforms like Spotify continue to play a central role in the podcast landscape in Germany. 36% of Germans use Spotify at least once a month, with 30% using it weekly. It has become the go-to platform for both music and podcast consumption, particularly among younger audiences. For publishers, Spotify is the battlefield, where they need their content to be discovered by leveraging Podcast Visibility Optimization, for example.

Interestingly, like in other geographies, YouTube is also emerging as a key player in the podcasting space, especially among younger listeners. While traditionally a video platform, YouTube’s vast user base and its appeal to younger demographics make it an important venue for podcast discovery. Repurposing podcast episodes into video content, such as audiograms or video podcasts, can help reach a wider audience and capture the attention of users who may not be traditional podcast listeners.

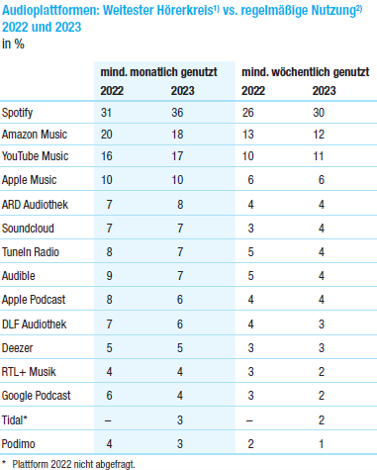

Listening Platform Usage in Germany – 2023 vs 2022

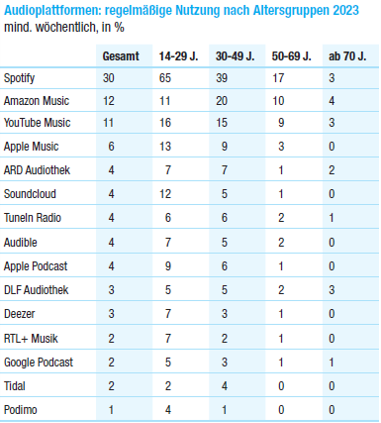

Listening Platform Usage in Germany by Age Group

Finding #4: Smartphones as the primary device for podcast listening

No surprise here. With 65% of podcast consumption via smartphones, mobile accessibility is crucial for podcast publishers. Listeners must ensure that their content is mobile-friendly, especially the cover art of their shows.

Finding #5: Promoting podcasts on radio

Despite the rise of podcasts, traditional radio remains dominant in Germany, particularly among older listeners. To leverage radio’s massive reach, podcast publishers should consider promoting their shows with radio stations. Be it internal cross-promotion (a radio promoting native podcasts produced by the same radio station), buying ads if economically relevant, or mentioning that the show listeners currently enjoy is also available on demand.

Finding #6: Podcast advertising is becoming of age

8% of the German population listens to podcasts daily, giving advertisers both the reach and frequency they need to allocate more budget to the medium. And like in other countries, podcasts offer a highly engaged audience, and ads embedded in podcast episodes often perform better than traditional online ads. For advertisers, podcasts provide a unique opportunity to connect with listeners more personally and directly.

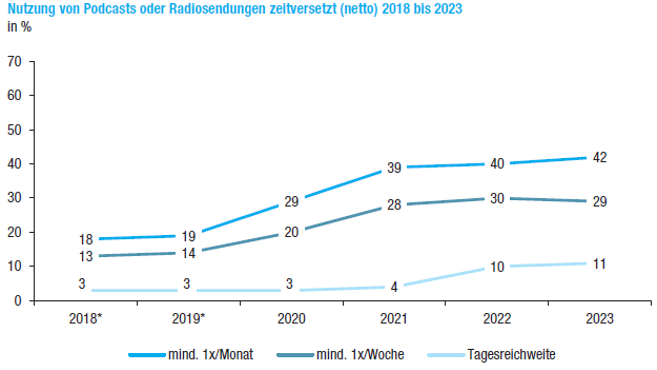

Podcasts or Radio Replay usage frequency from 2018 to 2023.

The future of podcasts in Germany

The German audio market is at an exciting crossroads. Traditional radio maintains its strong presence, while digital formats like podcasts and streaming services continue to gain momentum.

This presents both opportunities and challenges for podcast publishers. While podcasts are still a growing medium, their increasing popularity among younger audiences offers significant opportunities for audience expansion. What’s happening in Germany mirrors trends across the EU, underscored by the country’s demographic shifts.

To succeed in this evolving landscape, podcast publishers need to stay ahead of the trends. This involves optimizing the visibility of their shows on platforms like Spotify and YouTube, while also delivering content that resonates with key demographics. Audiotiq’s L'optimisation de la visibilité des podcasts (PVO) service is designed to boost your podcast’s discoverability on platforms like Spotify, where being found is crucial. Paired with our Podcast Cover Optimization, you can ensure your podcast will not only be seen but also clicked and, therefore, listened to.